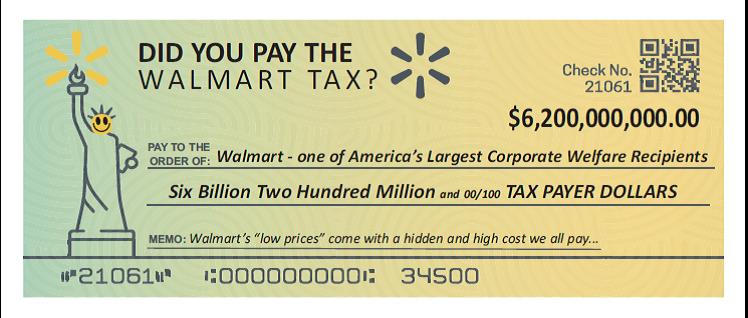

OMG — It’s Gone Up to $7.8 Billion!

Report by: Americans For Tax Fairness

WALMART ON TAX DAY:

How Taxpayers Subsidize America’s Biggest Employer and Richest Family:

Introduction On tax day, when millions of American taxpayers and small businesses pay their fair share to support critical public services and the economy, they will also get stuck with a multi-billion dollar tax bill to cover the massive subsidies and tax breaks that benefit the country’s largest employer and richest family. Walmart is the largest private employer in the United States, with 1.4 million employees. The company, which is number one on the Fortune 500 in 2013 and number two on the Global 500, had $16 billion in profits last year on revenues of $473 billion. The Walton family, which owns more than 50 percent of Walmart shares, reaps billions in annual dividends from the company. The six Walton heirs are the wealthiest family in America, with a net worth of $148.8 billion. Collectively, these six Waltons have more wealth than 49 million American families combined.

This report finds that the American public is providing enormous tax breaks and tax subsidies to Walmart and the Walton family, further boosting corporate profits and the family’s already massive wealth at everyone else’s expense. Specifically, our analysis shows that: Walmart and the Walton family receive tax breaks and taxpayer subsidies estimated at more than $7.8 billion a year – that is enough money to hire 105,000 new public school teachers….

Read Full Report Here