Who Pays Taxes in America in 2019?

For years, Americans have been told that the rich are paying a highly disproportionate share of the nation’s taxes.

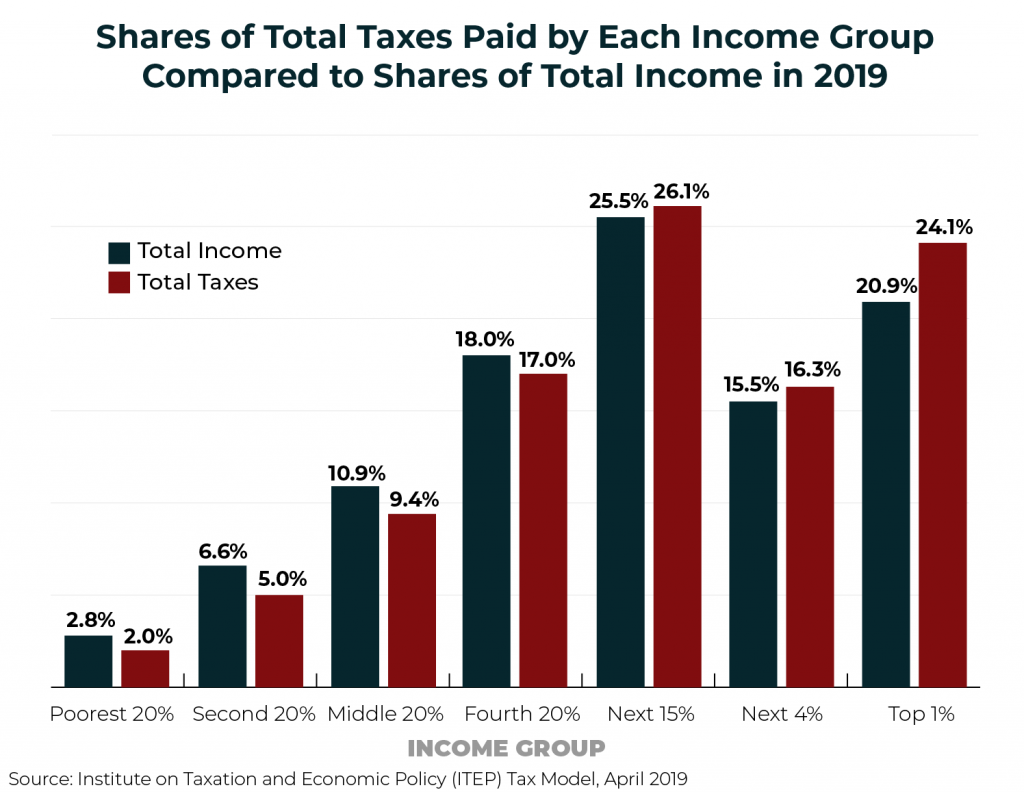

Claims to that effect often focus on just one tax, the federal personal income tax, which is indeed progressive overall. But when the nation’s tax system is viewed in its entirety, it becomes clear that the reality is very different. Despite their enormous incomes and wealth, the nation’s richest taxpayers are paying a share of overall taxes that slightly exceeds their share of income. As illustrated in the graph below, in 2019, the richest 1 percent of Americans will collect more than $1 in $5 of income in the United States (20.9 percent) and will pay a slightly higher share of the nation’s overall federal, state and local taxes (24.1 percent). Meanwhile, the poorest fifth of Americans will receive only a small fraction of the nation’s income (2.8 percent) and, as a result, will pay a small fraction of the total federal, state and local taxes (2 percent).